nh business tax calculator

You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202223. New Hampshire Income Tax Calculator 2021.

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

The first the business.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

. SB 190 would switch the way New Hampshire apportions a companys profits for tax purposes to determine the BPT Tax owed based on the sales of services from different. The Business Enterprise Tax the BET is an entity level tax imposed upon all business enterprises slightly different than business organizations for. For Taxable periods ending on or after December 31 2016.

New Hampshire Business Profits Tax BPT If you operate a business within the state of New Hampshire youll have to pay taxes on any profits that you make. SmartAssets New Hampshire paycheck calculator shows your hourly and salary income after federal state and local taxes. Ad Avalara calculates collects files remits sales tax returns for your business.

The Business Profits Tax BPT was enacted in 1970. Business Profits Tax BPT and Business Enterprise Tax BET New Hampshire levies two separate taxes on companies doing business in the Granite State. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001.

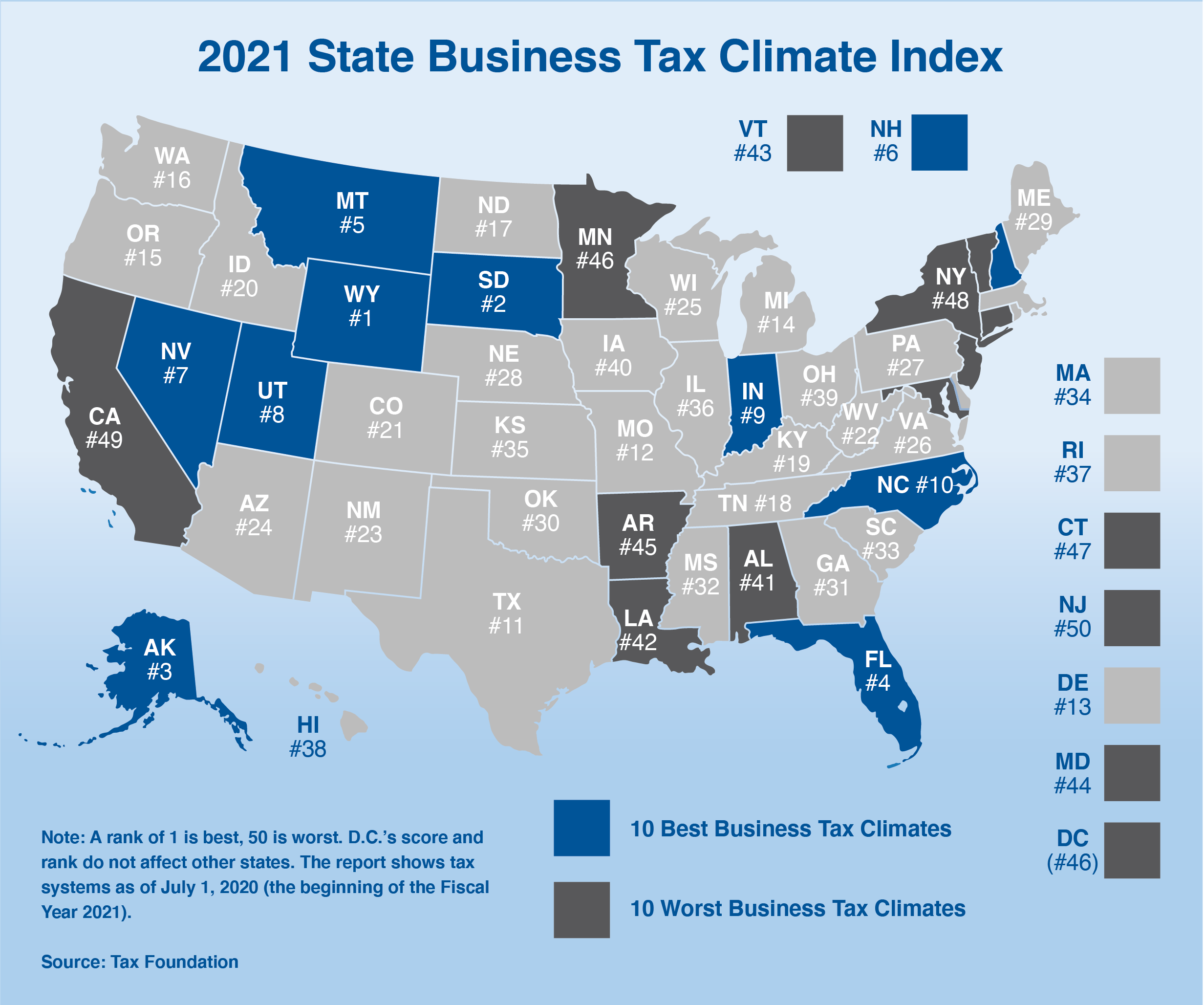

If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. The New Hampshire corporate income tax is the business equivalent of the New Hampshire personal income tax and is based on a bracketed tax system. Find our comprehensive sales tax guide for the state of New Hampshire here.

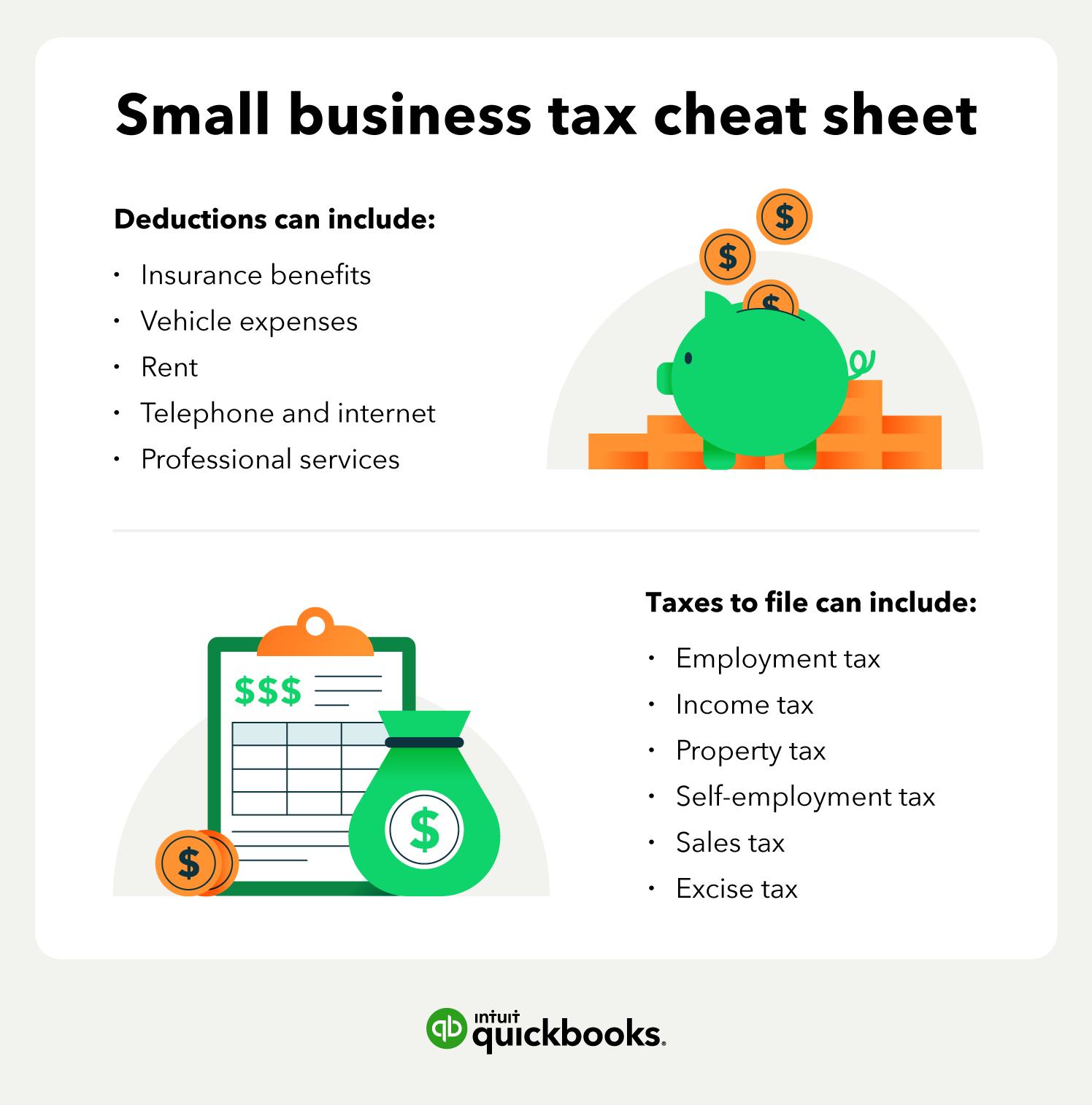

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Individuals and businesses may. Our calculator has recently been updated to include both the latest.

Enter your info to see your take home pay. The New Hampshire Business Profits Tax BPT rate went from 82 to 79 and the New Hampshire Business Enterprise Tax BET rate dropped from 072 to 0675. Business Enterprise Tax RSA 77-E.

For taxable periods ending on or after. The tax is assessed on income from conducting business activity within the state at the rate of 77 for taxable. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price.

501c3 federally exempt organizations operating in the state of New Hampshire with gross receipts in excess. Ad Uncover Business Expenses You May Not Know About And Keep More Of The Money You Earn. No Matter What Your Tax Situation Is TurboTax Self-Employed Has You Covered.

If you have a substantive question or need assistance completing a form please contact Taxpayer. For donations up to 60000 to a qualifying scholarship program. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001.

New Hampshire Income Tax. If you have filed with New Hampshire Department of Revenue Administration after 1998 you can pay your Business Enterprise Tax BET and Business Profit. Our small business tax calculator.

Businesses the gross less. All businesses except Sec. Minimize sales tax compliance risk with automated solutions from Avalara.

Your average tax rate is 1198 and your. Organizations operating a unitary business must use combined reporting in filing their New Hampshire Business Tax return. NH State Tax Calculator Community Tax.

For example if you have a. The New Hampshire Business Enterprise Tax. E-File Help - Business Tax Help.

The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0. For transactions of 4000 or less the minimum tax of.

Self Employed Tax Calculator Business Tax Self Employment Self

Free Llc Tax Calculator How To File Llc Taxes Embroker

What Canadian Businesses Need To Know About U S Sales Tax

Sales And Use Tax In Usa Nexus Art Business Law

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Altered State A Checklist For Change In New York State Empire Center For Public Policy

State Corporate Income Tax Rates And Brackets Tax Foundation

What New Hampshire Has Business Taxes Appletree Business

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Finances Money

How Do State And Local Corporate Income Taxes Work Tax Policy Center

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Free Llc Tax Calculator How To File Llc Taxes Embroker

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll

Elegant Cpa Certified Public Accountant Business Card Zazzle Certified Public Accountant Accounting Corporate Business Card

Small Business Tax Services What You Should Know Article

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax